Why Guaranteed Income plan with an Insurance ?

It is good to get fixed income over a long term compared to highly volatile returns.

Volatility is the risk which says the investment returns can go up and down, there is a high probability of ending with negative returns as well.

You can see Guaranteed income plans in different names from most of the Insurance companies.

Let us look at Insurance products and how this Guaranteed income plan works in this article.

Different Life Insurance Products

One of the popular scheme is Money Back policy, in this once in 4 years you will get regular income which can help you to pay your policy premium or you can utilize that for any other purpose. On maturity you will get a smaller bonus along with the premium paid.

Whole life policy provides coverage for the entire life, if the premium is paid for life time. You will get lumpsum benefit on the death of the insured.

Earlier LIC use to provide a policy which can double your money in 15-20 years timeline. Once the private players started entering Insurance market, they also started offering similar products.

In the last few years, Life long income or whole life income or regular income policies are becoming popular.

ULIP – Unit linked Insurance policy provides market linked insurance policy. Your investment will be invested in stock market and the returns will be based on the market performance. During 2004-07, there were severe mis selling happening in this ULIP policy. 2008 market crash has eroded the invested money in these ULIP policies. Since then several regulations came in place. Charges has been brought below 10% which use to be in double digit. Lock in period has been increased to 5 years from 3 years.

What is an Insurance ?

First of all you should understand the need for insurance and how it can help you in critical point in life. Insurance is not an investment tool and you should not confuse risk protection tool with returns out of it.

Insurance is a risk protection tool. You may be the only bread winner in your home and in your absence, your family may start facing financial difficulties. An insurance policy may provide financial cushion immediately.

Term, Health, Critical illness and Personal accident policy are some of the most important insurance you need in your life.

Term Insurance is the risk protection tool which can take care of your family in your absence. Financial losses due to your absence can be taken care.

Health Insurance can take care of your hospital expenses and this can help you to get best treatment without worrying about the cost involved. In one of the survey they found that, Most of the deaths in India are happening because of not having health insurance and insufficient money for treatment.

Critical Illness policy will help you to get one time settlement for major critical illness and with this money you can take sufficient rest even if you lose your job.

Personal accident policy can help you in getting compensation for partial, temporary and permanent disabilities. Even minor and major treatment cost will be covered under this policy.

There are other insurance policies which can protect you from financial liabilities and some are mandatory if you are doing business.

How mis-selling happens in Insurance ?

Below are some of the ways where you will be mis-sold an insurance policy. This can happen through bank managers & Insurance agents.

- You wanted to invest in mutual fund and the bank manager would have sold you an ULIP. NAV, returns, fund names etc are all almost similar between mutual fund and ULIP.

- You wanted to park your money for few years and you would have been sold an One time premium paying policy with lock in period.

- You may be paying ULIP for close to 10 years and you would have got a call to close the existing policy and park your money in a guaranteed Insurance policy

- If you say that you don’t want to take any risk, you will be sold a guaranteed income plan.

- If you say that you need good returns in long run, you will be sold a ULIP plan.

- If the stock market is doing good, you will be sold ULIP on the pretext that equity can generate higher returns.

- If the stock market is volatile or in bear phase, you will be sold a guaranteed income plan

How to protect yourself from insurance mis-selling ?

If someone is selling you a guaranteed income plan or ULIP, understand his intention.

You should be asked about the financial risk which is there in your life. An insurance policy should be able to cover the entire risk with lesser premium.

You should also understand the difference between Mutual fund and ULIP, ULIP is not mutual fund.

Develop the basic understanding of needed insurance you should have in your life.

Why Guaranteed Income plan with a policy ?

Life Insurance policy with fixed deposit kind of returns had many takers. LIC was the trusted Government guaranteed company and it was easy to make everyone take with double benefit of savings & risk protection.

Since inception, LIC has provided the returns as mentioned in their policy at the end of the term. All other insurance companies which came into existence also launched similar policies and different variants over a period of time. Even across the world this is the case.

Though IRDA suggest indicative returns of 4 % & 8 % to be provided by Insurance companies, all the insurance companies were able to provide the maturity benefit as promised.

One of the major benefit of having Life insurance is getting a loan from the premium you have paid at a fixed interest rate.

Right now most of the companies have launched guaranteed income plan with different tenors of even upto 50 years.

One thing which is common among all these policies are the returns which are lesser than 6%. Right now the inflation rate is around 5-6% only. Therefore the effective returns out of this investment is NIL.

Is this guaranteed income plan worth taking ?

You may get sizeable guaranteed income only if you are able to pay a minimum of 1 lakh per year for 10 years.

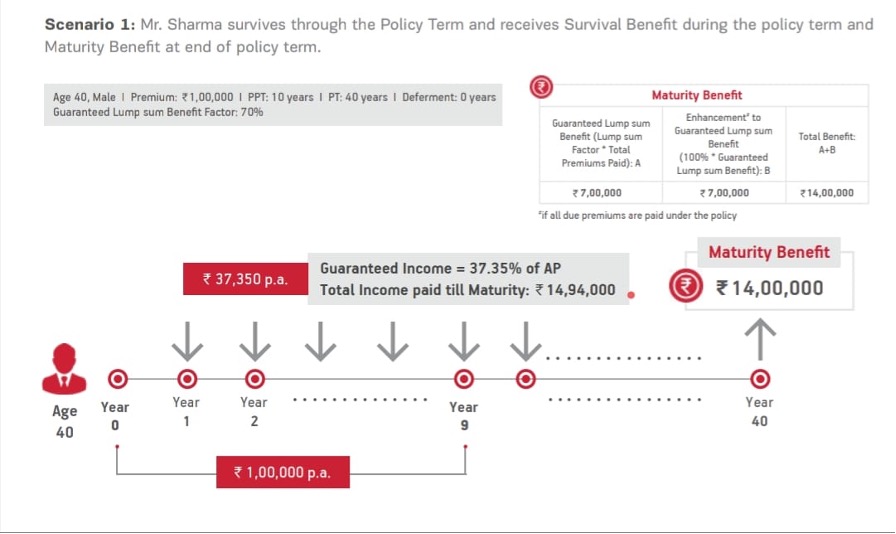

Let us look at this guaranteed income plan from one of the insurance company,

You need to pay 1 lakh per year for 10 years.

Survival benefit in this 40 years is 14.94 lakhs which is 37350 per year.

Maturity benefit of another 14 lakhs at the end of 40 years.

Total benefit of taking this policy is close to 29 lakhs in 40 years on the premium payment of 10 lakhs in the initial 10 years.

37,350 may be a bigger amount in the initial 10 years and the money depreciation makes this amount as peanuts after 10 years.

Maturity benefit of 14 lakhs after 40 years is worth just 2 lakhs considering Money value depreciation.

If you are looking for regular income for longer period of time, consider investing in mutual fund and opt for SWP in mutual fund.

Refer our blog article https://ganesanthiru.com/unlimited-wealth/how-to-get-regular-income-from-mutual-funds/