What are the equity mutual funds scheme types ?

How much returns can equity mutual fund generate ?

There are different equity mutual funds scheme types, which we have to understand to answer the above question.

In general most of equity mutual funds scheme types have always provided double digit returns. In excess of 15% over the period of last 2 decades. UTI equity mastershare is the first mutual fund started in 1986. Till date in the last 30 years have given around 18%

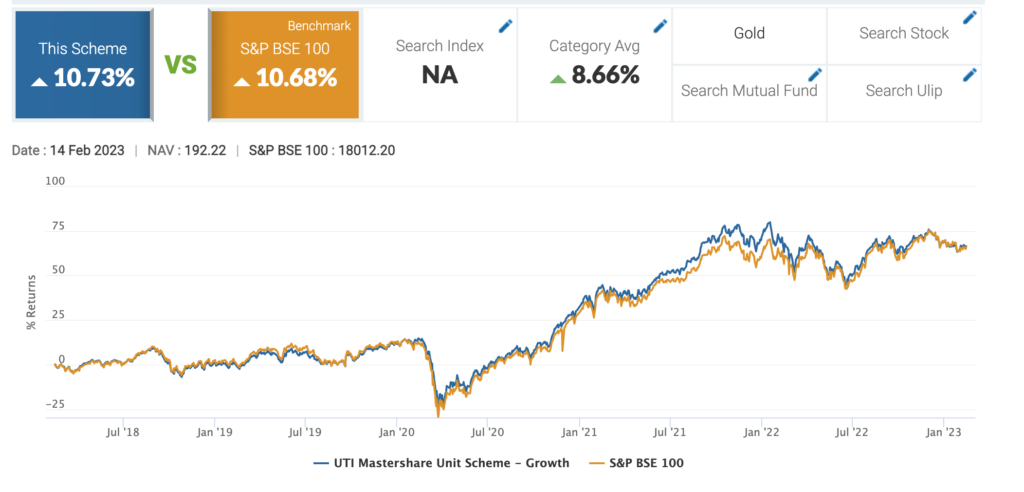

Here is snapshot of last 5 years.

Many have utilised this fund for generating excess returns in the last 30 years. Some are still investing in this fund as compounded returns is still exemplary. This is just shown for illustration purpose.

In the current scenario, for tax saving purpose only ELSS Mutual fund can give you better returns with less lock in period. Also read best tax saving investments in 2023. Inflation will eat into the returns of other fixed income products. In 2000’s the interest rate have stayed above 10%. So does the inflation rate. Am referring both inflation rate and interest rate as people may expect the interest rate to go higher in the future. This may not happen as we are moving towards capping inflation lesser than 4%. Most of the nations have changed their policy to cap inflation. Their interest rates have stayed lower once it is done. India is one of the few countries were the returns have stayed higher due to high inflation rate.

Equity mutual funds and scheme types

Main categories of equity mutual funds scheme types have been listed below,

Large cap,

Small & mid cap,

Diversified,

Sectoral,

Thematic,

International Funds,

Balanced funds

ELSS

Large cap mutual fund

Large cap shares are the companies with market capitalisation in the top 30 lists. They are bigger and are referred as Blue chip as well. Large cap are proven companies which are in the market for longer period and has stable returns.

Hence people interested in getting stable returns from equities can invest in this fund. It can usually generate over and above benchmark returns of 12%. Among equity funds, large cap gives standard return as the companies are huge and some are cyclical. Generating bigger returns for such a massive company is very difficult. Some of the companies will go in a acquisition spree and miss on the returns for some of quarters. Hence the returns of around 12% is really better.

Some of the large cap companies or Blue chip companies which is in the market at present are Maruti, SBI, TCS, Infosys, Ambuja Cement, Tata Motors, Reliance, ONGC etc. Companies with market capitalisation which comes in the top 30 are classified as Large cap companies.

Small & Mid cap mutual fund

Generally companies which has market capitalisation next to large cap can be categorised as Small & mid cap funds. They usually generate returns as per the economic cycle. During recession or economic downturn it may produce negative returns or flat returns. When economy moves higher it will produce huge returns which large cap cannot give.

Hence people who wants to huge returns over a period of 4-5 years can invest in this small & mid cap funds. Risk associated with this fund is usually higher as funds may turn negative at times due to market crash, due to internal macro economic conditions or Global woes pertaining during that period. Some of the mid cap companies are Axis Bank, Tech mahindra, NIIT, Kotak Mahindra bank etc. Generally companies from 30 till 300 are classified as mid cap companies. Rest of the companies are classified as small cap companies.

Reason for this fund being so popular or people chasing this fund is that it can make a fortune in short span when ever it is performing. It may not give good returns for a period of 2 to 3 years, but it can double the returns in the next six months to one year. Fund managers toil hard to identify these particular stocks which can impact the returns in a big way. Franklin India prima has been in existence for a period of more than 20 years and it has given more than 18% compounded returns ( Till 2016 ).

Diversified mutual fund

Diversified fund will have holdings across large, small and mid cap stocks. The composition varies depending upon the market condition. Fund manager can choose which is best for the fund to perform well in their category.

People looking for better returns than Large cap can choose this type of funds as well. Diversified doesn’t have to stick to any one category of funds. Fund managers have the free hand to choose the best shares which may go big in the next quarter or next one year. Market goes through a cycle, sometimes small & mid cap stocks beats large cap and other sectors. At times market is steered forward by large cap companies. fund managers churn the right stock at the right stage of market movement.

Sectoral mutual fund

Sectoral funds will invest only in those stocks, for example pharma is a sector and Mutual funds in pharma sector will invest only in this sector specific stocks. Hence there may be a inherent risk if the market isn’t favourable for that sector.

Sectoral funds have performed have done well over the period of 10 years and better than other equity funds. There is risk associated with it and you need to stay invested in the fund for longer period. For a economy to move forward it needs to grow in automobile, Banking etc. So if you are convinced that these sectors will move forward in the long run, then you can invest with long term returns in your view.

Some of the sectoral stocks in automobile is maruti, tata motors, Honda Siel, Motherson sumi, force motors, TVS motors, Mahindra & Mahindra etc. If you take banking stocks you have SBI, IOB, Indian Bank, Axis bank, ICICI, Yes bank, DCB, city union bank etc.

Thematic mutual fund

Thematic funds can be easily understood based on the prevailing condition in India. In 2016, Government has been chanting “Made in India” theme and some of the funds have been launched with this as theme.

Do not enter into such thematic funds unless you understand well about the mutual fund holdings or recommendation from your advisor. During 2007-08, infrastructure funds have been in demand and there were many launches along with natural resource theme based funds. UTI infrastructure and Reliance natural resources fund were launched during the second half of 2008 were the market was moving down. These 2 funds were later merged with existing funds inside their fund houses.

International funds

International funds provides the advantage of equity market in other nations. A fund investing in global equities may provide advantage of returns from those markets if the market isn’t performing well in India.

Risk associated with this fund is forex charges as amount invested in rupees will be converted to forex and then invested in their currency. Again while selling also forex charges will get applied. So better avoid if you are not so sure about this risk.

Fund of funds

Generally pool of funds are collected, then invested in some group of funds. If you are risk averse consider investing in these funds. It is better to know in which other funds your money will be invested in. Usually debt funds with lesser weightage of equity funds will be chosen for investing.

ELSS or Equity Linked Savings Scheme or Tax saver mutual fund

ELSS has the advantage of investing in equity with lock in period of 3 years. It has generated a minimum benchmark return of more than 12% in this lock in period. This has been one of the best tax saver option as you get the benefit of getting tax exemption under section 80C. The returns are completely tax free within a period of 3 years.

Balanced mutual funds

Balanced fund is also called as equity mutual fund as they invest more than 65% in equities and remaining in debt funds. It is better to invest in this fund if you are bit conservative initially. In the longer run, Balanced funds have done really well compared to large cap.

Risk associated with the fund is that sometimes equity holdings may exceed more than 70% and they may be in small & mid cap stocks for getting better returns.

How to choose among these mutual funds scheme types?

At times having so many options may be confusing. If you are trying hard to start with a fitness regime, it is better to start with a fast walk. Then slowly you can think about hitting the gym. Do your mutual fund investments is also on the same line. Start with debt funds, then move into large cap. Don’t worry if you are said that you are missing small & mid cap fund boom, there is always a next bus. Understanding the fund you are investing in equity mutual fund is more important than blindly investing based on some one’s advise. It may go wrong as they wouldn’t have said about the associated risk. Another easy option is to leave it to the financial advisor who can serve you at the best.

Why this is best for your Long term Investments?

The primary reason being compounded return of 12%. By the rule of 72, the chances of your equity investments getting doubled up in a quick time. Investing during market rally can increase the chance of doubling your returns up within a year. If you are a keen market watcher you can deploy more funds during this period and earn more. SIP is the best mode for people who don’t watch market regularly.

Some of the best performing funds in the last 20 years have given more than a minimum of 15%. If you are planning for your retirement life which needs to stay for a longer period of more than 20 years, this can be useful. Planning for your child education, planning for closing the home loans in a period of 6 to 7 years by investing can be done with equity mutual funds.

To know more about equity and other kinds of mutual funds for investing find here my course on mutual funds.