Pension Withdrawal from SWP in Mutual Funds ?

Pension provides income security, but not all governments and jobs are entitled to pension provisions therefore it becomes your responsibility to save from your income during your earning period. Also, withdraw the same as pension using SWP in Mutual Funds. Read more in this blog to find how you can withdraw pension using systematic withdrawal plan in mutual funds.

What is SWP in Mutual Funds ?

Mutual fund is one of the best investment tool to achieve your financial goals. There are different types of mutual fund which can be used for accumulating wealth. The different types of mutual funds are Equities, Balanced and Debt funds. It is often said that for a conservative investor, Debt funds are the best since it can offer returns better than bank interest rates. However it is only best suited for people who want to generate returns in the short to medium term.

It is always the difference in technique which is recognised and rewarded by people, for instance in an online e-commerce business more than volume of sales and availability of varieties, what stands out is, it brings in ease of buying things from comfort of home. And ofcourse technology plays an important role in this development. Similarly, Investment can also be approached in a better way to gain maximum profit out of it.

SWP can help you in receiving something like pension directly into your bank account on the date you want.

How to Invest through SWP in Mutual funds;

Different options in mutual funds can be used effectively for getting better returns. Many who know about mutual funds think SIP is the only option available in mutual fund investments and they want quick money.

An other available option to invest in mutual fund is,

SWP – Systematic Withdrawal Plan

SWP is used to withdraw an amount every month on a particular day. This can be useful for retired persons who have corpus money and expect good returns over their living period. Also for single men or women who have got immediate corpus from insurance.

For example, ICICI Prudential discovery value fund falls under diversified equity fund category and it is taken as an example for this SWP,

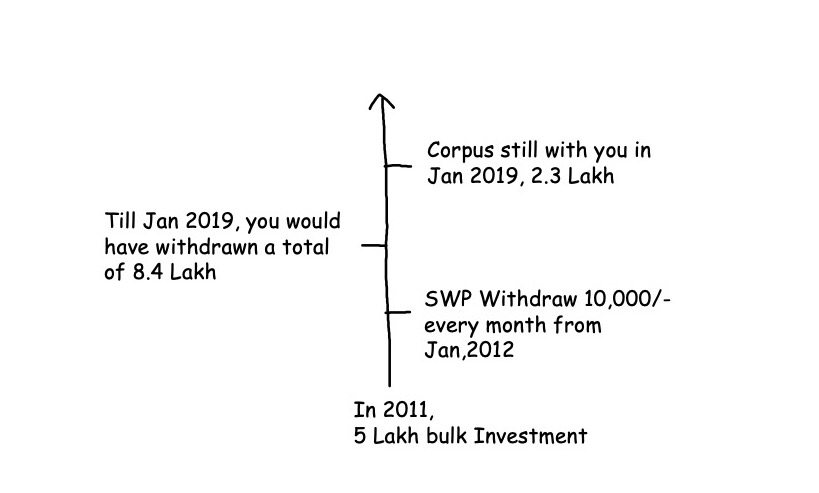

If one had invested 5 lakh in 2011 and started withdrawing 10000 from Jan, 2012 you would have withdrawn 8.40 lakh till Jan, 2019 and still the left over amount in the account is 2,30,547. Investing NAV in 2011 was 42 and at present it is 134.

While investing 5 lakh, 11644 units (5 lakh/42) are purchased initially. During SWP period every month amount equalling to unit value is redeemed. As of now around 1714 units are left over. Hence the latest value is 1714*134 = 2,30,457.

Obviously the market upturn during election had favoured good returns for this investment type, but still it is a good option for retired persons and others.

Pension for retirees ?

SWP options can be beneficial for those who don’t believe in lumpsum investment for long term investment purpose. Though it is easy to believe that in the long term Mutual fund NAV’s have increased considerably for all the equity mutual funds. The inherent risk associated with equities have forced people to be on the defensive side. This can be beneficial for retired personal or if you had got bonus and looking for avenues to invest and expect monthly income out of bulk investment along with growth.

SWP can help you with monthly cash flow as well as it keeps growing. In the above example, while investing the NAV was at 42. After 7 years the NAV is at 134. NAV has increased by more than 100 points. Check out the withdrawn amount which is around 8.4 lakhs. Still the left over corpus is around 2.3 lakhs. This is best suited for people receiving Pension.

Consider investing the same amount in any fixed deposit at 9% returns. Your withdrawal will last only for 5 years and 2 months only.

If you want to live with interest alone, then the yearly interest generated is around 45000 and after 7 years your corpus will be the same 5 lakhs. Remember that interest rate has gone down to less than 7% in these years.

i) Withdrawing Amount at periodic intervals

This has been shown as an example in the above section, where the amount will be invested across equity mutual funds and then withdrawal date every month along with the fixed amount will be mentioned. On that date every month monthly amount will be transferred to investors account.

ii) Bulk investment with monthly income

Generally mutual fund has been advertised or made to believe as a monthly investment tool similar to recurring deposit, it can also be used to receive monthly income based on our bulk investments. After 2010, the interest rates are on the decline. People who get pension are the worst affected. As the interest rates had gone down, their interest amount on the corpus has also gone down considerably. This had affected their retirement or pension life.

There were many who will have bulk investment of more than 10 lakh to 50 lakh and even more. Invest in high performing equity mutual funds for a period of more than 5 years so that one business cycle goes through.

Returns for the entire period of even ten years can be more than 10% which is on par with other financial products. If the investment period is good or market has performed exceedingly well, then your investments can give you income for extended period.

To learn more about how to invest in mutual funds check out my course.

This same blog is explained in below youtube video as well.